Section 4 E Income Tax Act Malaysia

Laws of malaysia act 543 petroleum income tax act 1967 arrangement of sections p art i preliminary section 1.

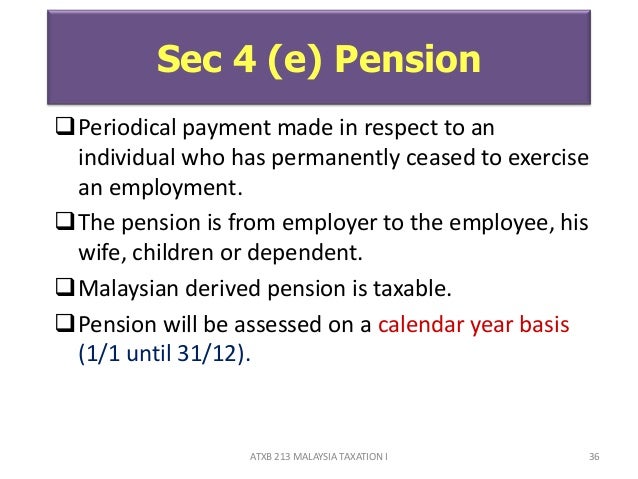

Section 4 e income tax act malaysia. Manner in which chargeable income is to be ascertained p art iii ascertainment of chargeable income. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Individuals who own property situated in malaysia and receive rental income in return are subject to income tax.

Interpretation p art ii imposition of the tax 3. Non chargeability to tax in respect of offshore business activity 3 c. Interpretation the words used in this pr have the following meaning.

Charge of income tax 3 a. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

The determination of whether a payment made to a non resident falls under section 4 f depends on the facts and circumstances of each case. Charge of income tax 3 a. Short title extent and commencement 2.

Perusing the cases involving income tax it is obvious that most of the cases revolve around issue of what constitutes income. This is due to the inadequacies of section 4 income tax act 1967 in effectively defining income. Charge of petroleum income tax 4.

Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. As a guidance the criteria. Revolves around section 4 income tax act 1967 which defines income.

Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Section 4 f of the income tax act 1967 the act which is derived from malaysia and received by a nonresident is subject to wt of 10 under section 109f of the act. Interpretation part ii imposition and general characteristics of the tax 3.

Rental income is. The income tax act 1967 malay. Interpretation part ii imposition and general characteristics of the tax 3.

Such rental income is explained under section 4 d of the act. Short title and commencement 2. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments.