Sales Service Tax Malaysia 2018

Or b imported into malaysia by any person.

Sales service tax malaysia 2018. Sales services tax 2018 kalendar. Sec 8 1 sales tax act 2018 a tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him. Following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence.

Malaysia sales tax 2018. The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. On 8 august 2018 the royal malaysian customs department rmcd issued a list of proposed taxable services for service tax purposes.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. Jabatan kastam diraja malaysia. Updated on 20 august 2018.

Although a familiar tax malaysia has adopted sst for four decades the days leading up to sst s second coming has nonetheless been filled with controversy and confusion. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Service tax 19 7 2018 11 03.

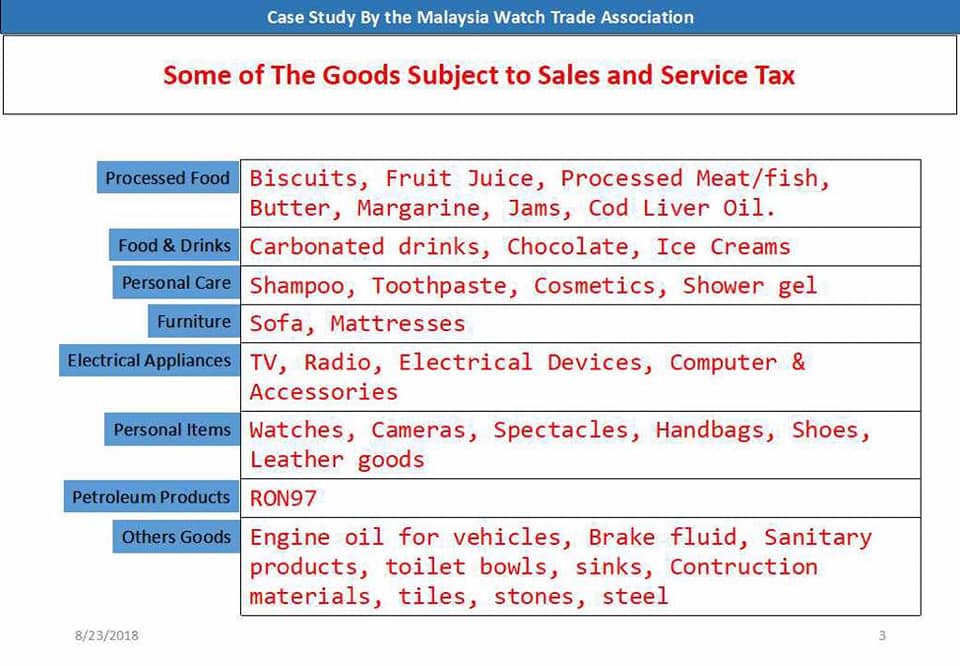

Scope charge sales tax is not charged on. The proposed rates of tax will 5 and 10 or a specific rate. According to chong 2018 sst is an enhanced version of the earlier sales tax act 1972 and service tax act 1975 which governed malaysia s indirect tax arena for more than four decades before.

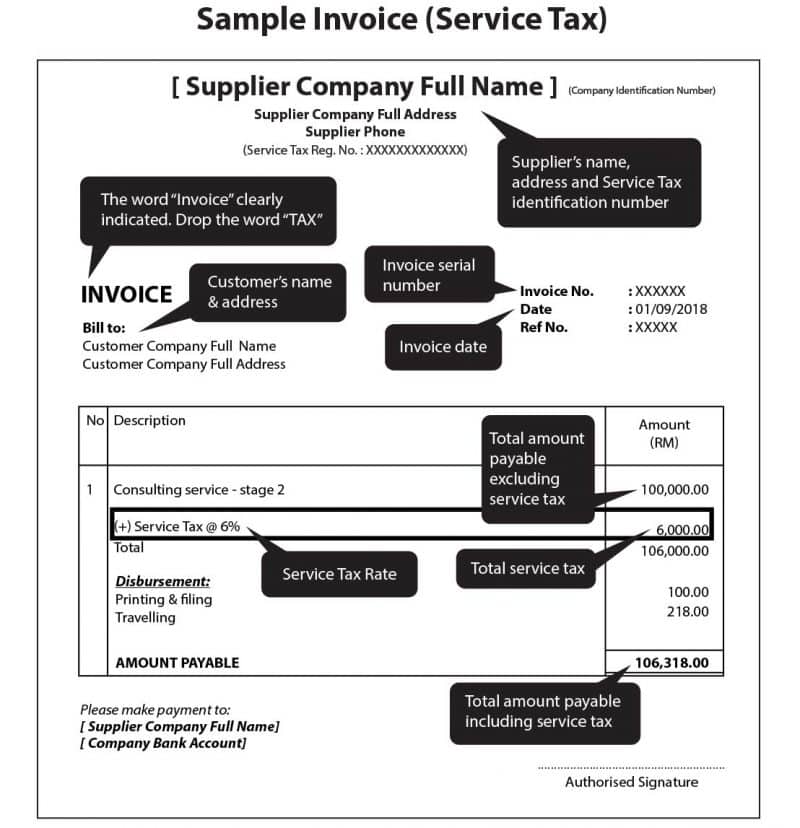

Sales tax sales tax is charged on taxable goods that are manufactured in or imported into malaysia. Service tax taxable services proposed. The list also provides a comparison of the taxable services and registration thresholds between the old service tax regime and the upcoming regime.

One rumour purports that sst escalates the tax burden to 16 being a combination of sales tax at 10 and service tax at 6. Sales and service tax sst in malaysia.