Sales And Service Tax Malaysia Wikipedia

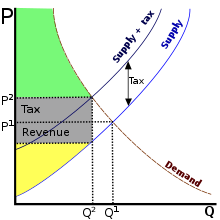

Under the new sales tax and service tax framework announced on 16 july 2018 sales tax is levied on the production of taxable goods in malaysia and the importation of taxable goods into malaysia at a rate of 5 or 10 or a fixed percentage depending on the category of goods.

Sales and service tax malaysia wikipedia. A tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him. Service tax applies to prescribed taxable services provided by prescribed taxable persons. Or b imported into malaysia by any person.

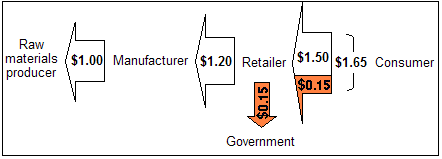

Governed by the sales tax act 2018 and the service tax act 2018 the sales tax was a federal consumption tax imposed on a wide variety of goods while the service tax was levied on customers who consumed certain taxable services. A sales tax is a tax paid to a governing body for the sales of certain goods and services. There are no input or exemption mechanisms available for service tax.

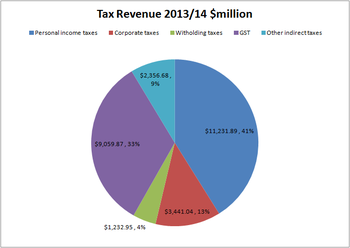

Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase when a tax on goods or services is paid to a governing body directly by a consumer it is usually called a use tax often laws provide for the exemption of certain goods or services from sales and use tax. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into malaysia. Before the 6 gst that was implemented in 2015 malaysia levied a sales tax and a service tax.

The existing standard rate for gst effective from 1 april 2015 is 6. Service tax is also a single stage tax charged once by the service provider. Service tax is a final tax with no credit mechanism.

The proposed rate of service tax 6. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

The goods and services tax is an abolished value added tax in malaysia. With effect from 1 january 2019 service tax also applies to imported taxable services. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline.

When any services are sold out sst malaysia tax is applied that is 6. Scope charge sales tax is not charged on. Persons exempted under sales tax persons exempted from payment of tax order 2018.

Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.