Real Property Gain Tax Act 2017

The tax deducted is calculated based on the profit a seller may make from selling a property.

Real property gain tax act 2017. Among them were some fundamental changes that affect primary residence homeowners as well as owners of investment real estate. On december 20 2017 president trump signed the tax cuts and jobs act of 2017 tax act ushering in an extensive array of new tax laws. Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property.

Where this information is reported depends on the use of the property main home timeshare vacation home investment property business use or rental use. An act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto in its simplest form it s basically a tax charged on the capital gain or net profit a seller makes when he or she sells a property. Readers should not act on the basis of this publication without seeking professional advice.

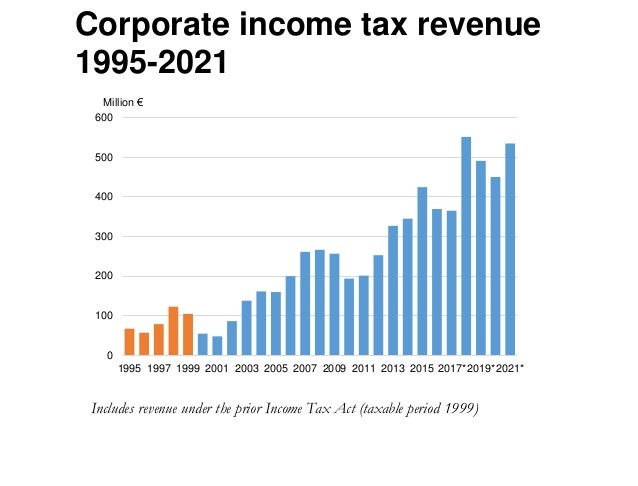

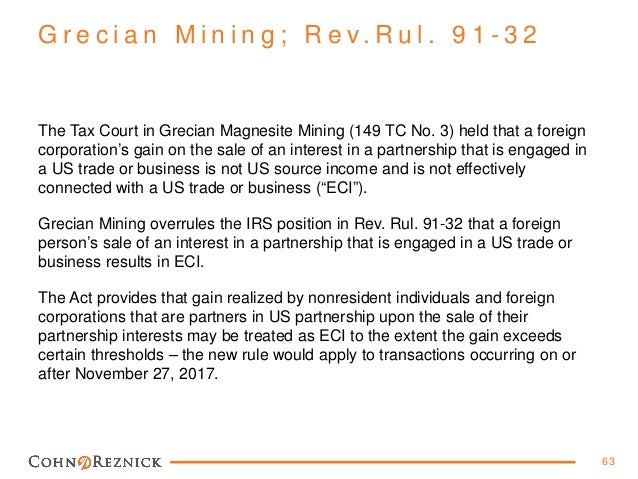

Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. Form 1099 s proceeds from real estate transactions is used to report proceeds from real estate transactions. Further to the above on 1 st january 2018 the finance no 2 act 2017 came into effect with amendments to the real property gains tax act of 1976.

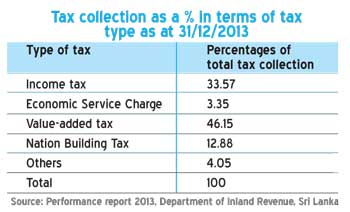

Real property gains tax scope. Recently the government announced that they were making three amendments to the real property gains tax rpgt in budget 2017. Use the unrecaptured section 1250 gain worksheet in the schedule d instructions for this purpose.

Primary residence homeowners mortgage interest deduction. The finance no 2 act 2017 fa received royal assent on 27 december 2017 and was introduced to amend the income tax act 1967 the real property gains tax act 1976 rpgta the goods and services tax act 2014 and the finance act 2013. A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

This article will discuss the amendments to the rpgta as provided in sections 16 17 and 18 of the fa. This act may be cited as the real property gains tax act 1976 and shall be deemed to have come into force on 7 november 1975. To figure the amount of unrecaptured section 1250 gain to be reported on schedule d form 1040 you must also take into account certain gains or losses from the sale of property other than your home.

Real property is defined as.