Real Property Company Malaysia Lhdn

Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc.

Real property company malaysia lhdn. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia. Lhdn malaysia www hasil gov my lembaga hasil dalam malaysia introduction real property gains tax rpgt is charged on gains arising from the disposal sale of real properties or shares in real property companies rpc submission of rpgt form disposal not liable to includes. A controlled company is essentially a company owned by not more than 50 members and.

The malaysian companies act 2016 3 real property shares in rpcs the controlled company must hold real property or shares in an rpc and the defi ned value of the real property shares in the rpc must make up at least 75 of the total tangible assets of the company for the company to be an rpc. Real property is defi ned in the rpgt act. Maklumbalas akhbar lhdn sukar dihubungi talian hasil careline utusan malaysia 12 april 2018 lhdn sukar dihubungi talian hasil careline utusan malaysia 12 april 2018 media response where s the money.

What is real property gain tax rpgt. Rpgt is also charged on the disposal of shares in a real property company rpc. Both individuals and companies are subjected to rpgt.

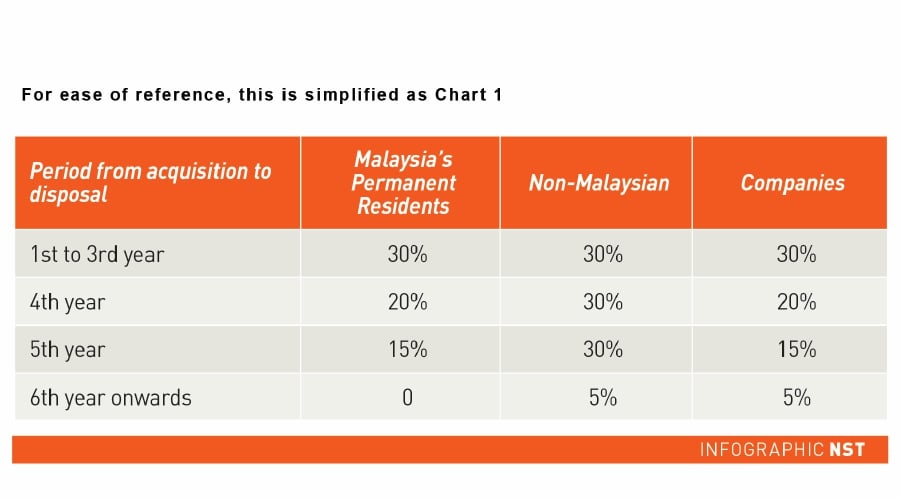

Generally malaysia does not charge any capital gains tax neither does malaysia have a cgt regime on sale of shares. According to the real property gains tax act 1976 rpgt is a form of capital gains tax levied by the inland revenue lhdn. Rpgt is generally classified into 3 tiers.

Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. The star 3 4 april 2018. In malaysia rpgt is a tax imposed by the inland revenue board lhdn on chargeable gains which find their source in the disposal of real property.

This fact is specified in the real property gains tax act 1976 act 169. Shares in real property company rpc. Following the previous post on real property gains tax rpgt this post aims to shed a spotlight on another field of transaction which will also attract rpgt sale of shares in a real property company rpc.

The exception being profit accruing from the sale of real property. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Pursuant to real property gains tax act 1976 real property gains tax rpgt is tax charged by the inland revenue board lhdn on gains derived from the disposal of real property such as land and building.